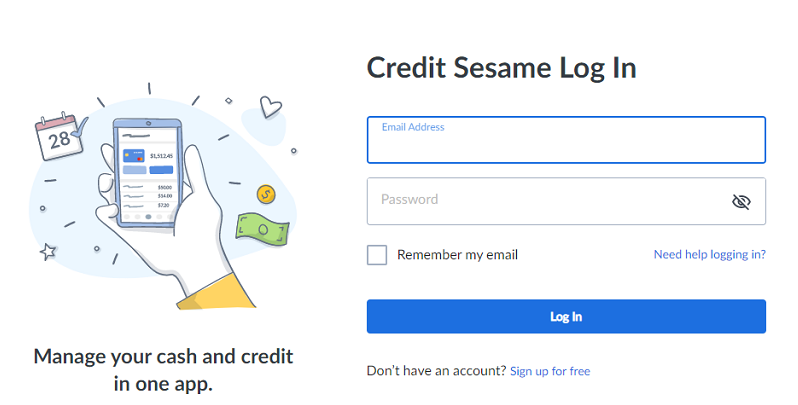

Credit Sesame Login: How To Access Your Credit Sesame Account

Use the Credit Sesame login page as a member to see your credit score and loan analysis or manage your online account at the Secure.CreditSesame.com website.

About Credit Sesame

Credit Sesame is a credit and loan company. Credit Sesame was launched in private beta at TechCrunchDisrupt 2010. By 2012, the company claimed to monitor almost $35 billion in loans.

No credit card is needed to see monitoring, personalized recommendations, and setup identity protection or insurance in web accounts.

Credit Sesame automatically pulls in your credit information every month from TransUnion’s VantageScore, including your free credit score and your debts, and always for free. With the aid of our Robo Credit technology, we deliver customized recommendations that help you make the most of your finances.

Credit Sesame Login Steps

Once your Credit Sesame login is accepted on the website, setup your home value and track equity in detail to get mortgage and refinancing options that will be tailored to your profile.

Modules are found in the following categories: Credit Cards, Home and Automotive insurance, ID theft, loans, and credit score.

Start at https://secure.creditsesame.com/s/login and enter your Credit Sesame login email address and password to authenticate to your account.

Problems with your log in session are resolved by clicking “Need help logging in? or by calling 1-800-881-6590 and speaking with someone in the Mountain View, California support office or using the password reset tool found at the bottom of this page.

Your account will provide you with consumer education advice, a free credit score, and no obligation monitoring of your history through organization of loans and market conditions.

Identity theft insurance and protection is free with registered members for up to 50,000 in losses on compromised cards. All data in Credit Sesame accounts is guarded with bank level security and strict information handling on your login credentials.

New users will answer a few short questions during account creation to set preferences and financial goals. Once complete, your financial analysis will run and update automatically.

Applications for student and personal loans are both located inside your account and you may be prompted to answer additional financial questions before being approved.

The Home category includes purchase and refinance instructions that you can accept or reject depending on your house ownership status.

Your credit card is only required for a purchase and not to run a free credit score report. For all other features, you will be prompted for your Credit Sesame login information to access online.