Bestow Life Insurance Login: How To Manage Your Policy Online

Bestow is a life insurance company that wants to make getting life insurance very easy. They focus on using big data rather than medical exams and needles to underwrite the life insurance policies they offer. Continue reading below for Bestow Life Insurance Login page where you will sign in to manage your policy online.

All of your policy information including beneficiaries, billing, and contact information is accessible in your Bestow Life Insurance Login also known as the Bestow Member Portal. This article will help you to login using your username (your email address) and password that you set up in your application.

What You Need To Know About Bestow

Bestow’s site is clean and easy to navigate. If you are first time customer, You can get an initial quote by entering your birth date, height, weight, gender and ZIP code, then apply for a policy after that.

If you have questions about your policy, you can contact the team via live chat, email or phone. If you’re a beneficiary, you can start the claims process on Bestow’s site. Then, you’ll receive a claims packet from the North American Company for Life and Health Insurance.

Bestow Life Insurance Login Steps

If you need to access your policy information, Bestow’s online customer portal makes it easy to download your policy documents, view your beneficiary information, and change your payment method. However, If you have a Bestow Life Insurance online account, you may access it at any time.

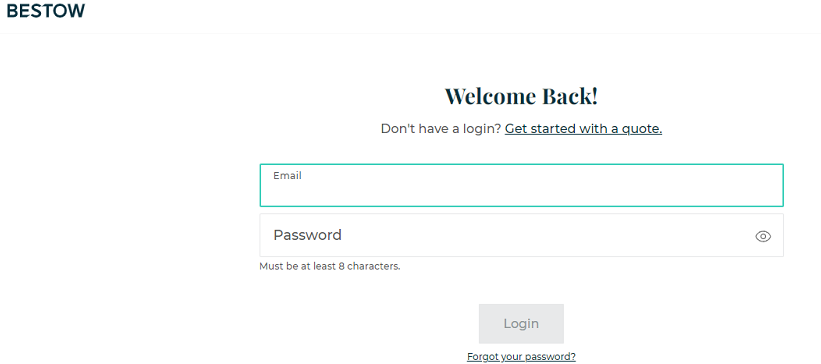

It’s simple to log into your online account, and you’ll need your login details. To log into your online account, follow these simple steps:

To sign-in to your Bestow dashboard, simply go to https://login.bestow.com and enter the username and password that you created during the application process.

Bestow Customer Service

If you need to get in touch with Bestow, you have a few options. You can call the company at (833) 300-0603 or send an email to [email protected]. However, the quickest way to get customer support is to use the live chat feature.

Just click the live chat button on the page and you can get connected to a live representative instantly.

Bestow Life Insurance Login Frequently Asked Questions

1: I’ve been locked out of my account, how do I reset? The most likely reason that your account was locked out is that you’ve entered an incorrect password five times. If this happens, just give them a call at 1-833-300-0603

2: How do I log out? To log out of your Bestow Member Portal, click your name in the top right-hand corner and press the “log out” button.

3: I forgot my password, what do I do? Forgetting your password is the worst! But they’ve got you covered. Simply click the “forgot password?” link at the bottom of the login page or call 1-833-300-0603, and we’ll be happy to help you reset your password. You’ll be emailed a link by which you can reset and create a new password.

4: How do I change my credit card information? You can edit your credit card information through the customer portal. Log in and click “Billing” on the left-hand navigation bar. You will be taken to the billing screen which will display the payment schedule and your current payment method. If you click the “Edit” button beneath your current payment method, you will be able to change your credit card information. Simple as that!

If you are updating your payment information due to a missed payment, please contact them at [email protected] or 833-300-0603 once your credit card is updated to let them know they can charge your new card for the missed payment.

5: How does my beneficiary file a claim? They’re here for you. To file a claim, you can contact them at 1-833-300-0603 to speak with one of their Customer Care Advisors. They’ll guide you through the next steps in order to process your claim as quickly as possible.

6: Do I get a refund if I cancel my policy? You are eligible for a full refund if you cancel within the first 30 days. After the 30-day mark you do not receive a refund but future payments are cancelled and there are no termination or early-cancellation fees.

What If I Still Have Questions? No worries. We got your back. You can ask in the comment box below.