Check City Login: How To Manage Borrower Account Online

Payday doesn’t always come when you need it. But with a fast and convenient payday loan from Check City, you don’t have to wait. However, the Check City Login portal allows you to access manage your loan account online. You can make a payment, set up autopay, view your active loans, check your loan balance and more.

Check City customers have the assurance that they are in personable, friendly, and welcoming hands. However, if you are a Check City loan borrower, looking for information on how to access and manage your Check City loan account or make a loan repayment, this post can help.

Check City Member Benefits

According to Check City, taking care of their customers is their number one priority. Be the first to know about Check City promotions when you become a Check City member and get access to exclusive deals for their loyal customers.

1: Instant Funding: Get an instant loan! Check City’s fast funding just got even faster! Now instant funding is available to all returning Check City customers. All you have to do is select “Instant” as your preferred “Funding Method” when taking out a Check City loan. Then you’ll use your debit card to instantly load your loan funds into your checking account. It’s that easy!

*Certain loan terms, conditions, and restrictions may apply. Please contact a Customer Service Representative at (800) 404-0254 for details.

Instant funding is currently only available to online and in-store customers in Utah and Nevada. Direct deposit, or ACH payments, are available to all online customers. Cash funding is available to all in-store customers in Utah, Nevada, Colorado, and Virginia.

2: Refer a Friend: Check City members can share the Check City difference with others by referring a friend with our Refer a Friend program All you have to do is fill out a referral card online or at your local Check City store and you can earn $30! Refer a Friend Today.

Check City Login Steps

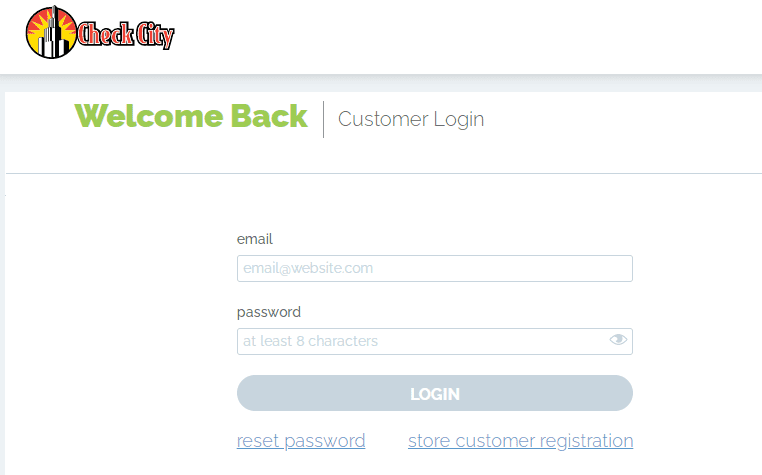

In order to manage your Check City account online, you have to log in to your online account. The login process is very simple. You must have a valid email address and password to access the login portal. Those who don’t have their login credentials, have to register first.

However if you already have your login credentials, then simply follow these simple instructions below to access your Check City borrower account online.

- To sign in, go to https://members.checkcity.com/Member_Login.aspx

- In email, type the email that you selected when you signed up for online account.

- In Password, type your password.

- Click LOGIN

In case, customer forget their login credentials such as email or Password, then use the “reset password” link to retrieve it.

Check City Member FAQs

Check City has a professional and friendly customer service team that’s always ready to answer any of your questions and help out however they can. Below are a few commonly asked questions you might have about your Check City account.

1: How do I become a Check City Member? Check City customers automatically become a Check City Member after they’ve successfully completed their first loan. This Membership comes at no extra cost to you and provides exclusive benefits like their newest product features and the opportunity for special discounts.

2: How do I check the status of my loan application? If you’ve recently submitted a loan application with Check City then you can check your application’s status on the customer dashboard after logging into your account.

3: How long does it take for a loan application to get approved? After you submit any necessary documents, the loan application can take up to 15 minutes to get processed. If it has been longer than 15 minutes, check your email or watch for a call from 800-404-0254, Check City may have some additional questions.

4: How do I check my next payment due date? You can see your payment schedule, your next payment due date, and the payment amount all on your customer dashboard after logging into your online Check City account.

5: What documents do I need to submit with my loan request? After you submit your loan application you will be directed to a document upload page if additional information is needed to process your loan request. From there you can upload the requested information directly and it will be attached to your loan application.

Check City prequalifications for a loan are as follows:

- Current steady source of income

- Valid telephone number and email address

- Open and active checking account

- Valid social security number or tax ID

Depending on the loan option(s) available in your state, direct deposit and length of employment may be considered.

6: Can I get an extension on my loan? Whether you can get an extension on your loan will depend on several factors like which state you live in. See the rates and fees page for your state for more details. Extensions are only available in Alabama, Alaska, Nevada, and Utah.

7: Can I delay my loan payment? Typically, loan payment due dates cannot be modified unless your paydays have changed.

8: What if my payday has changed? Email an updated paystub to [email protected] and type “Change in Payday” in the subject line. Then call 800-404-0254 to confirm they received the updated paystub and have made the chance. If you have a current loan, they can determine what steps will be necessary to update your loan due date(s).

9: How do I refinance my loan? If you have an installment or personal loan (available in select states) and you have credit available, you may be eligible to refinance your loan. The common reasons to refinance a loan are to update a payment schedule, to access additional credit, or to pay down the principal and reduce payments.

If you want to refinance your loan a successful payment must have been made at least six days prior to the refinance request date and a minimum of $100 in credit must be available. Simply, click the refinance button on your loan tile found on the dashboard.

10: How much can I get approved for at Check City? Loan amounts are based on your income and other factors, loan limits will be determined on an individual basis.

How To Contact Check City Customer Service

If you have any other questions, you can contact Check City customer service team at our toll-free number: (800) 404-0254

For additional Check City contact information, visit the Check City Contact Us page.

Related Posts: