How To Make Your Trustmark Mortgage Payment

The easiest option for most homeowners is to make their Trustmark Mortgage Payment is through either their bank or Trustmark Mortgage servicing website. Online payments are fast, free and efficient, and paying online means you can decide when you want to make the payment, maintain a record of when it was made and ensure that it is paid by the due date.

This article contains general information regarding managing your Trustmark Mortgage online account. Additionally, it discusses steps you need to take in order to register your Trustmark Mortgage account online for the first time, including when and how to make your Trustmark Mortgage payment online. This guide will help you understand everything you need to know about how Trustmark online Mortgage works.

How To Enroll In Trustmark Mortgage Online Access

If you are a new user, you can only manage your Trustmark Mortgage account online through the Trustmark Mortgage servicing website. Before accessing myTrustmark Mortgage Portal, you must have online account with a unique username and password. When you enroll in Trustmark Mortgage online account access, you will have 24/7 access to your account information and also, you will be able to;

- Make Your Trustmark Mortgage Payment online

- Check current loan balances

- 12-month payment history

- Year-to-date totals

- Payment due dates

- And a whole lot more!

- Don’t forget…By enrolling in Trustmark Mortgage online account access, you will also be able to pay your mortgage online with AutoPay.

- To register your CMG Mortgage account online kindly go to https://trustmark.login.sagentapps.com/signin/register and enter your Last name, Date of birth, and email address.

Note: When creating a Trustmark Mortgage servicing password, you must use both alpha and numeric characters (letters and numbers). No other types of characters will be accepted. Also, passwords must be a minimum of six characters to a maximum of eight characters long.

How To Make Your Trustmark Mortgage Payment

When you take out a mortgage, you might feel uneasy at the thought of carrying debt and paying high interest costs over time. Paying off your mortgage early, however, could help you save money and rid yourself of some financial stress. Before you make extra mortgage payments or zero out the debt entirely, you should consider whether it’s the best move for you. It may make sense in some circumstances, but not all.

If you’ve decided that paying off your mortgage early is the right move, there are many ways to go about it. You don’t have to throw your entire savings account at the debt. Instead, consider these options for paying off your mortgage early:

However, with a wide variety of online payment options available, you can pay your mortgage loan whenever and however you choose.

1: Pay Online: To make your Trustmark Mortgage Payment online you need to be logged in your online account. If you are a new user and doesn’t have an online account kindly follow the steps above to enroll In Trustmark Mortgage Online Access. However, if you are an existing customer, follow these steps to log in to your account and make your Trustmark Mortgage Payment online.

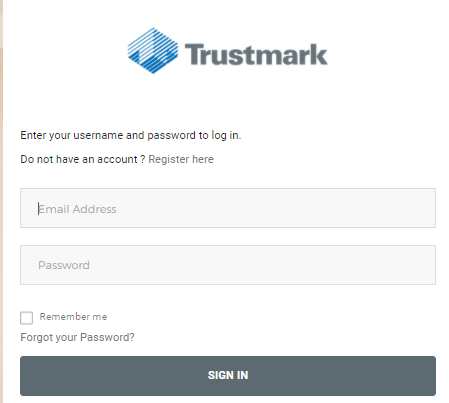

- Visit https://trustmark.login.sagentapps.com/

- Login to your account by putting a valid Email and password.

- Go to the Make Payment option.

- Now put your payment details including the amount you wish to pay.

- Recheck the payment details and click the continue button.

If you’d like to make an expedited payment without registering or logging in using your debit card, “Click the URL below ($9.95 fee applies)”

Pay as a guest: https://paybill.com/consumer/?ClientId=Trustmark

If you want to process guest payment using your bank ACH “Click the URL below” (free of charge).

Pay Now by Bank-Ach: https://consumer.sagentapps.com/Trustmark/LoanService/GuestPayment

2: Automatic Payments: Automatic payments, or autopay, can be a smart way to “set it and forget it” and pay your bills each month without doing much work. The automatic withdrawals from your bank account can be set up to pay for your mortgage payments.

This free service allows your mortgage payment to be automatically deducted from your bank account on the 1st-15th of each month. Sign Up Today

3: Pay by phone: Payments received after 2:45 CT will be processed the next business day.

Self-service option

Choose option 9 from the main menu. Available 24/7/365; there is no charge for this service.

800.844.2400

Customer service assisted option

Available Monday – Friday, 8:00 a.m. – 5:00 p.m. CT; there is no charge for this service.

866.229.1656

4: Pay at a Trustmark branch: Receive same day credit for payments made at a Trustmark branch.

Find a Nearby Branch

5: Pay with Speedpay: Make a one-time payment online with Speedpay. Available 24/7/365; there is no fee for this service.

Make a Payment

6: Pay by mail: Mail your payment to the address below.

Trustmark

Attn: Mortgage Services

P. O. Box 23072

Jackson, MS 39225-3072

7: Mortgage Loan Payoff Request: Send your payoff request via email or call one of Trustmark

mortgage loan Customer Service Specialists. Please provide your mortgage loan number and the date through which the payoff statement is needed.

[email protected]

800.844.2400

Read Next: Trustmark Bank Login: How To Access Your Trustmark Bank Account

Trustmark Contact Information

Call Them

800.243.2524

Directory Assistance

800.844.2000

Mortgage Loan Support

800.844.2400

Report a Lost or Stolen Debit or Credit Card

800.243.2524

Online and Mobile Banking Support: Assistance with Payments, Transfers, Deposits and more

866.794.5102

Report Fraudulent Activity on Your Account

800.243.2524

Contact a Trustmark branch

Find a nearby branch

Mailing Address

Trustmark

P. O. Box 291

Jackson, MS 39205

Corporate Headquarters

Trustmark

248 East Capitol Street

Jackson, MS 39201