Lendkey Login: How To Access Your Borrower Account Online

LendKey partners with credit unions and banks to offer various loans through its digital platform. Borrowers can apply online and check rates online for student loan refinancing with no harm to credit scores. The LendKey login portal allows co-signers to complete their portions of loan applications. Borrowers can also use the portal to access an account, continue a loan application, make a payment, view a statement and more.

However, this post contains general information regarding managing your Lendkey student loan account online. Start here to learn how to register for a user profile, find your account number, connect an account to your user profile, and manage your user profile online.

What You Need To Know About Lendkey

LendKey’s digital platform connects borrowers who need private student loans or refinancing loans with credit unions and community banks. Since 2009, LendKey has helped more than 135,000 people by funding $5 billion in loans. The company offers fixed- and variable-rate loans for undergraduate and graduate students.

The application process depends on whether you are taking out a new loan or refinancing. Either way, you apply online, and LendKey will match you with the best lender for your needs.

For new loans: You can apply if you are enrolled at least half-time in a degree-granting program from an approved school. If you lack credit history and steady income, you may need a co-signer for your application.

The company recommends applying at least one month before tuition is due. Processing and certifying a loan may take several weeks but generally happens in less than 30 days, according to LendKey.

You may receive conditional approval for your loan quickly after initial review of your application and credit report. But final approval won’t come until after you submit supporting documents and your school certifies the loan.

For student loan refinancing: Private and federal loans in the student’s name can be refinanced with LendKey partners. Parent PLUS loans, however, cannot be refinanced through LendKey at this time.

You can refinance your loans even if you are in school, as long as you graduated with at least an associate degree from a participating Title IV institution. But you might not want to: You will have to start paying your loans right away, and you could lose certain borrower protections.

If you are ready to refinance, you will start with LendKey’s “check your rate” tool online to estimate annual percentage rates and terms. The tool uses a soft credit inquiry that will not hurt your credit. If you select a loan and apply for it, the lender will run a hard inquiry that might temporarily lower your credit score.

Next, you will indicate the loans you want to refinance and provide documents such as a copy of your government-issued ID, proof of income and statements for each loan. After your documents have been approved, you will electronically review your loan disclosures and sign your loan agreement before LendKey pays off your old loans and creates a new refinanced loan.

Generally, this process takes at least 10 days and may be up to 30 days from the time you sign your loan agreement to the time LendKey pays off your loan. You are responsible for making your monthly payment with your previous loan servicer until that time.

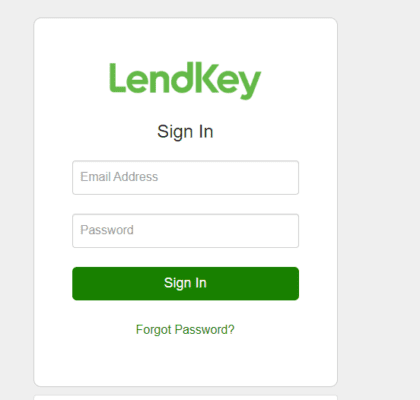

Lendkey Login Steps

If you already have an existing profile, you can proceed to login. It is simple to do this, but just to give you a quick start we can help you locate the login section with ease. You will need to provide some personal information to log-in to ensure that your account is protected from unauthorized access.

Step 1: Go to the Lendkey Login portal @ https://www.lendkey.com/consumer-login/?sk=organic and select your login Portal as listed below.

Borrower:

- Access your account

- Continue an application

- Make payments

- View statement & more

Student Loan Cosigner: Help a student by cosigning for their school loan. Complete your portion here. Student must apply before you can complete your portion.

Refinancing Cosigner: Cosign for a loan to help with student loan consolidation and refinancing. Borrower must apply before you can complete your portion.

How To Contact LendKey’s Customer Service

You can reach out by phone or email to customer service for help applying for or managing a loan.

For new loans or student loan refinancing, you can call 888-549-9050 from 9 a.m. to 8 p.m. Eastern time Monday through Friday, fax 800-583-1416 or email [email protected]. If you already have a loan, call 888-966-9268 from 9 a.m. to 8 p.m. Eastern time Monday through Friday, fax 800-915-6912 or email [email protected].

If you have a loan, you can also sign into the LendKey portal to complete a number of tasks.

Related Posts: